Bitcoin self-custody is the cornerstone of financial independence and self-sovereignty.

Collaborative custody, also called hosted or assisted custody, offers a sweet spot between complete self-reliance and trusting a third-party custodian e.g. exchanges. It leverages multi-signature (“multi-sig”) technology to let you hold your coins with enhanced security and support, without giving up control.

In this guide, we’ll explain collaborative Bitcoin custody in plain English. You’ll learn what multi-sig is, how collaborative custody works, and how it compares to doing multi-sig yourself.

What is Multi-Signature (Multi-Sig) Custody?

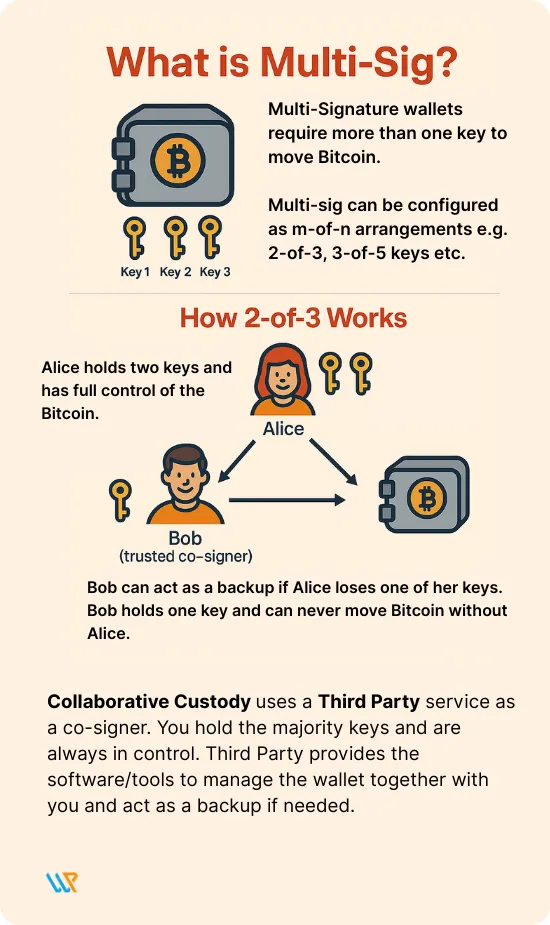

Multi-signature custody refers to storing crypto in a wallet that requires multiple private keys to authorize a transaction. Instead of a single key controlling your coins, a multi-sig wallet might be configured as “2-of-3,” “3-of-5,” or other m-of-n arrangements. This means, for example, in a 2-of-3 setup, there are 3 keys in total and any 2 keys must sign a transaction for it to be valid.

Multi-sig significantly enhances security compared to a single-key wallet. With a single key, anyone who obtains that key (or seed phrase) can spend the coins. With multi-sig, there is no single point of failure – an attacker would need to compromise multiple keys, and losing one key doesn’t mean losing access to funds.

Collaborative custody specifically refers to using multi-sig where you hold some of the keys and a trusted third-party holds another key. It’s a form of self-custody - the third party can never move funds on their own. You are always in full control of your funds, which is very different from leaving coins on an exchange.

DIY Multi-Sig vs Collaborative Custody

If you decide to use multi-sig for securing your Bitcoin, there are two broad approaches:

DIY Multi-Signature: Do it yourself. You create a multi-sig wallet on your own using multiple devices or keys under your control, with no third-party involved.

Collaborative Custody Multi-Sig: Use a service or partner who holds one of the keys and provides software/tools to manage the multi-sig wallet together with you.

Both methods offer the core security benefits of multi-sig, but they come with different trade-offs:

DIY Multi-Sig

Pros of DIY Multi-Sig:

Total Control: You don’t rely on anyone else. Only you (and any co-signers you designate, such as family members) possess the private keys. This eliminates third-party risk of theft or censorship.

Maximum Privacy: No provider can see your balances or transactions if you generate the multi-sig wallet offline. You can create and use addresses without linking them to your identity.

No Ongoing Fees: Aside from buying hardware wallets, doing it yourself has no subscription cost.

Cons of DIY Multi-Sig:

Technical Complexity: Setting up a multi-sig wallet manually (e.g., using Electrum, Sparrow, or Caravan) requires some know-how. You must ensure each device’s public key (xpub) is collected and a correct multi-sig address is derived. Managing this can be daunting for many.

Manual Coordination: You are in charge of key management – storing multiple seed phrases safely, keeping firmware up to date, and possibly maintaining a JSON or descriptor file that defines your wallet.

Difficult Recovery: If you ever lose one key or device, you’ll need your backups and technical skill to move funds to a new multi-sig setup.

Human Error Risk: Mistakes in setup (like not understanding address scripts or storing seed phrases incorrectly) can lead to loss. There’s no safety net if you are the only one in charge.

Collaborative Custody (Assisted Multi-Sig)

Collaborative custody involves partnering with a professional service that co-manages the multi-sig with you. Typically, you hold the majority of keys (e.g., 2 of 3), and the provider holds 1 key as a co-signer. The provider offers a platform to guide setup and help coordinate transactions. Essentially, they make multi-sig user-friendly and provide support if issues arise – in exchange for a fee or as part of their service.

Pros of Collaborative Custody:

Ease of Use: Providers like Casa, Unchained, and Nunchuk streamline the multi-sig setup so you don’t have to manually assemble keys or worry about technical details. The software will walk you through adding your hardware devices and automatically handle address generation.

Backup & Recovery Support: If you lose one of your keys, the collaborative model shines – the provider still has their key as a backup signer so you can recover funds with their help. You’re not suddenly locked out of your savings just because one key went missing, as long as you still have the other and the provider’s cooperation.

Ongoing Guidance: These services often come with customer support. You can ask for help, get questions answered, or use concierge onboarding services for setup. This hand-holding can be invaluable for non-technical users.

No Single Point of Failure: Like DIY multi-sig, collaborative custody eliminates single-key risk. Neither you nor the provider can single-handedly steal or lose the funds. It’s a balance of power that requires collaboration for critical actions, adding security.

Extra Features: Many providers bundle in useful features: inheritance planning, insurance or theft prevention policies, mobile monitoring apps, automatic health checks for your keys, etc.

Cons of Collaborative Custody:

Some Trust Involved: You have to trust the provider to secure their key and operate honestly. While they can’t move money alone, a negligent or compromised provider could fail to co-sign when needed or expose information. The model minimizes trust but doesn’t eliminate it.

Reduced Privacy: By involving a third-party, you inherently reveal information about your holdings. The provider will know your balances and can see your transactions (since they co-sign and often help coordinate the wallet addresses).

KYC and Regulations: Some collaborative custody firms are regulated financial companies and require full identity verification (KYC/AML) to comply with laws. This might be against the ethos of privacy for some users.

Cost: These services aren’t free. Most operate on a subscription model or have fees for premium support. You’re paying for convenience and expertise.

Dependency on Provider: If the company’s servers are down or the company goes out of business, you may need to perform manual recovery using your keys and technical know-how. Essentially, you are relying on the provider to be around for the long term – so choosing a reputable, stable provider is important.

Potential for Surveillance or Censorship: Because your provider can observe your wallet, in theory they could be compelled by authorities to report or restrict your transactions (even if they can’t steal your coins).

A Quick Comparison of DIY vs Collaborative

For a visual summary, here’s a comparison of key points between going solo with multi-sig and using a collaborative custody service:

| Aspect | DIY Multi-Sig | Collaborative Custody |

|---|---|---|

| Control over keys | 100% you (all keys) | Shared – you hold majority, provider holds one |

| Ease of setup | Complex manual setup | User-friendly (guided app/platform) |

| Technical skill needed | High – you manage everything | Low – provider handles coordination |

| Recovery from key loss | On you – need backups and knowledge | Provider assists with their backup key |

| Ongoing cost | Hardware purchase; no service fees | Subscription or fees for service (varies by provider) |

| Privacy | Maximum (no third-party knows your info) | Lower – provider knows balance & possibly identity |

| Trust required | None (no third-party in control) | Must trust provider’s integrity and security |

| Support & guidance | None from third parties (you’re on your own) | Yes – customer support, concierge services available |

| Features & add-ons | Basic wallet functionality | Extra features (inheritance, mobile app, integrations, etc.) |

Both approaches remove the single point of failure that haunts single-key wallets. The choice often comes down to how comfortable you are with the DIY route versus how much you value convenience and guidance.

When Does Collaborative Custody Make Sense?

Collaborative custody is particularly valuable in these scenarios:

If You’re New to Self-Custody: Beginners get guided introduction to holding keys with expert support.

Holding Significant Value: The more Bitcoin you hold, the more catastrophic it would be to lose access.

You Want a Safety Net: If something happens to one of your keys, someone has your back.

Shared Ownership or Family Holdings: Perfect for couples managing joint investments or family trusts.

Access to Ancillary Services: Some providers offer integrated services like Bitcoin purchases or loans.

On the other hand, if you’re extremely privacy-conscious or dealing with very small amounts, collaborative custody might not be the best fit.

Leading Collaborative Custody Providers

An overview of major players:

:- Key Arrangement: 2-of-3; Premium 3-of-5

- KYC Required: No (email only; anonymous signup possible)

- Supported Coins: BTC, ETH, USDT, USDC

- Pricing: $250/yr (Standard 2-of-3); $2,100/yr (Premium 3-of-5)

- Notable Features: Easiest UX with mobile app; Inheritance included in all plans; No KYC

- Key Arrangement: 2-of-3

- KYC Required: Yes (full KYC/AML)

- Supported Coins: BTC only

- Pricing: $250/yr; Concierge setup $1,200 (optional). Inheritance Protocol charged separately.

- Notable Features: Financial services (Loans, Trading, IRA)

- Key Arrangement: 2-of-3 Standard, 2-of-4 or 3-of-5 in premium plans

- KYC Required: No (email only for subscription)

- Supported Coins: BTC only

- Pricing: Free (DIY mode); $120/yr (Iron Hand 2-of-3); $450/yr (Honey Badger 2-of-4)

- Notable Features: Most devices supported; Can connect your own node; Privacy-first

- Key Arrangement: 2-of-3

- KYC Required: No

- Supported Coins: BTC only

- Pricing: $250/yr (Essential 2-of-3)

- Notable Features: Advisor-oriented features; Simple mobile interface

Frequently Asked Questions (FAQ)

Q: Is collaborative custody the same as giving up control of my Bitcoin?

A: No – with collaborative (assisted) custody, you retain control via your keys. Unlike an exchange or custodian where you have zero keys, here you hold the majority of keys. The collaborative partner cannot move funds without your approval (they don’t have enough keys alone). Think of it as co-owning a safe deposit box where two keys are needed: you have one key and a trusted person has the other – they can’t open it alone, but can help open it with you if needed.

Q: Can the provider steal my crypto or freeze my access?

A: Under normal multisig design, the provider cannot unilaterally steal your funds. For example, in 2-of-3, they have only 1 key; at least 2 keys are needed. As long as you hold your keys securely, the provider has no path to spend coins without you. The only “freeze” scenario is if you lost one of your keys and then the provider refuses to sign with theirs. In that case, with only 1 key left, you indeed couldn’t move funds until the provider cooperates.

Q: What happens if the collaborative custody company goes out of business or shuts down?

A: Your funds are under your control, as long as you have your keys. If a provider shuts down, the main inconvenience is losing their easy interface and their cosigner if you needed it. But since it’s multi-sig, you can use your own keys to recover. Every reputable provider gives you the information needed to spend from the multisig without them.

Q: Do I need to buy multiple hardware wallets for this?

A: It’s recommended to have at least one key managed using a hardware wallet for a 2-of-3 multisig. There are affordable hardware devices (~$60-$120 each). Also, some providers include devices in their packages (Casa Premium ships three hardware wallets as part of the membership). Using two different brands is wise for redundancy.

Q: What if I lose one of my devices or one of my seed backups? Do I lose my Bitcoin?

A: In a multi-sig, losing one component is not catastrophic (that’s the whole point!). If you lose one key, you still have another key plus the provider’s key to access funds. The procedure would be: use your remaining key + contact the provider to co-sign. Once coins are moved to a new safe address, you’d then re-establish a new multi-sig with a new replacement key. However, if you lose two keys in a 2-of-3 and only the provider key remains, then you’re in trouble – neither you nor the provider alone can spend.

Q: Are multisig addresses different? Can I still send Bitcoin to and from these wallets easily?

A: Multisig wallets use special Bitcoin addresses (either P2WSH or P2SH formats, often starting with bc1q or 3). For sending and receiving, they function like any Bitcoin address – you can send BTC to your vault address from an exchange or another wallet normally. When spending, you might notice the transaction has multiple signatures attached, but the process is handled by the software.

Q: Is multisig Bitcoin-specific? What about my Ethereum or other crypto?

A: Bitcoin has native multisig built into the protocol, which is why these services mostly focus on BTC. Ethereum and others handle multisig differently (via smart contracts). Casa is the only major provider which offers Ethereum and stablecoin support using a smart contract wallet.

Q: Can I switch providers or go back to managing keys myself later?

A: Yes. You are never locked in permanently. Because you hold the keys, you can at any time move your Bitcoin to a new wallet. For example, if you start with Casa but later decide to go full DIY multisig, you could create a new multisig on your own and then send the coins from your Casa vault to that new address (using your keys to sign).